does nevada tax your retirement

Nevada does honor Sales Tax paid to another state in an amount equivalent to Nevadas. If you file a federal tax return as an individual and your combined income is greater than 25000 you must pay taxes on your benefits.

9 States With No Income Tax Florida Nevada Texas Income Tax Inheritance Tax Income Tax Brackets

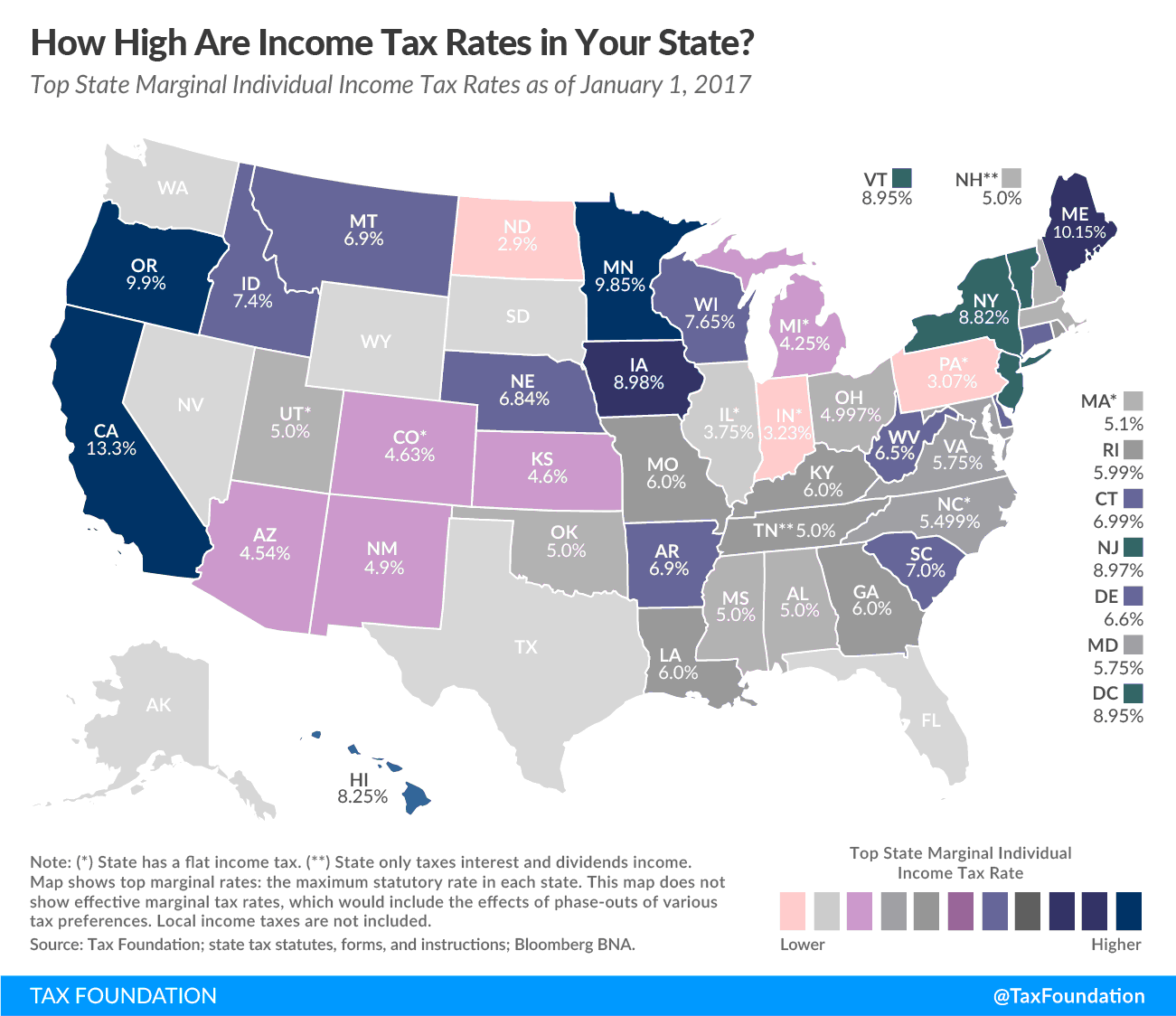

On the state level however Nevada doesnt have a state income tax.

. In fact this lack of retirement income taxation plus pretty low property taxes makes Nevada very tax-friendly toward retirees. 2 Of this number nine. The state ranked 28th highest for property tax collections in 2020.

By simulating a move to Nevada from California we find that Bob and Jane save over 156000 in taxes throughout their retirement. Yes if the boat is purchased for use or storage in Nevada. Starting with the 2022 tax year military retirement benefits will be fully deductible.

To the 50 states and the District of Columbia the tax picture for pension payouts is a bit more complicated. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Does Nevada Tax Your Retirement.

Nevada does not tax retirees accounts or pensions. Nevada gasoline tax is 3352 centsgallon. A patchwork of tax rules.

They are not taxed. It is based on retirement law effective from the 75th session of the nevada legislature 2009. Do I have to pay Nevada Sales Tax when I purchase a boat.

This is the list of the 37 states that will not impose a tax on your social security retirement income. One reason is that the state doesnt tax private or government pension income as long as it isnt for early retirement that is before age 59½. However for the 2020 tax year New Hampshire and Tennessee did tax investment income not earned income in the form of interest and dividends at 5 and 1.

401 ks and IRAs. They will need to withdraw 20000 a year from their retirement accounts to meet their desired retirement income. 40000 single 60000 joint pension exclusion depending on income level.

Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Here again there are many states 14 to be precise that do not tax pension income at all. For many people who are considering a financially-based move from California to Nevada an adequate understanding of how tax structures can affect them is important to their decision-making.

As of 2021 there are nine states with no income tax. Join us for an informational online webinar covering Taxes In Retirement on May 16 from 1130 AM - 1245 PM USPacific. Thus we crunched the numbers and present a concise yet thorough analysis.

40000 single 60000 joint pension exclusion depending on income level. 401 ks and IRAs. This makes your retirement income whether from your state pension or other retirement accounts tax-free.

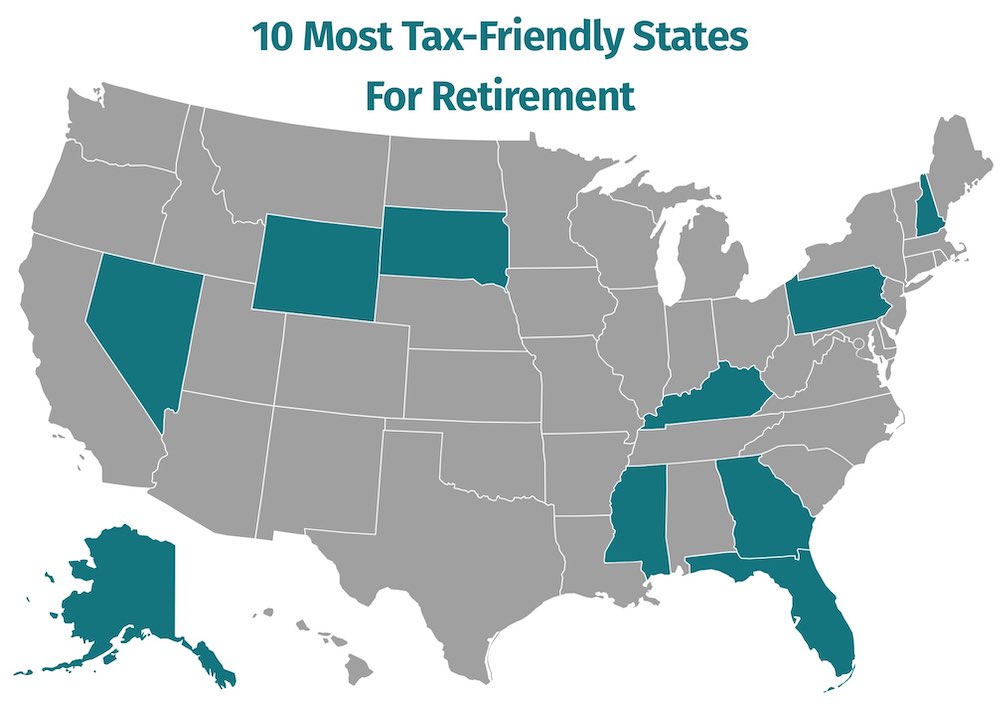

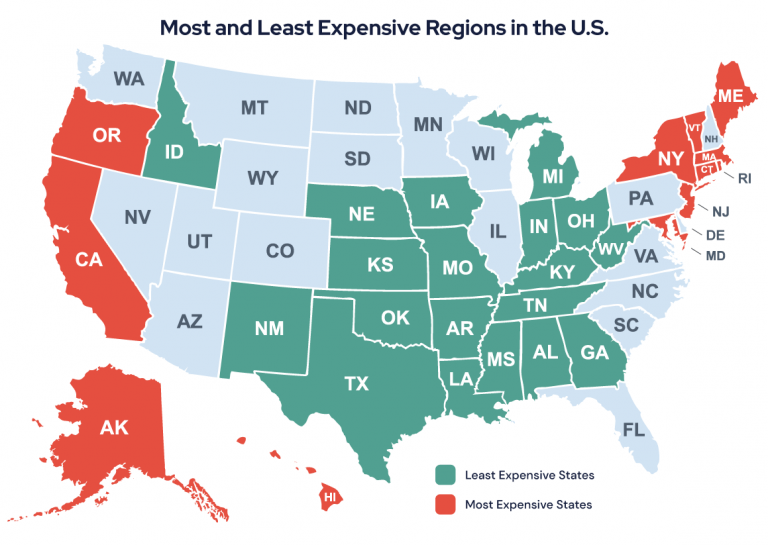

After we input these variables into our software we press Simulate. At 83 Total tax burden in Nevada is 43rd highest in the US. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire.

Nevada Investment Management Office. The webinar will equip you with the most up-to-date and comprehensive. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington Wyoming do not have a state income tax.

They are not taxed. If you work and start receiving benefits before full retirement age your benefits will be reduced by 1 for every 2 in earnings above the prevailing annual limit. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due.

Withdrawals from retirement accounts are not taxed. As a percent of value property tax paid is 84. Social Security and Retirement Exemptions.

Nevada sales tax is less than in California. Subjecting a higher proportion of your Social Security to income tax. What state has no income tax.

Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire Alabama. 5 tax on interest dividends. States With No Income Tax Eight states dont impose an income tax on earned income as of 2021.

A ninth state New Hampshire only taxes capital gains and dividend income. This state fully taxes military retirement income with an exception for Congressional Medal of Honor recipients. Nevada has no income tax.

However the state will take its share of 401k IRA or pension income received by those. NAC 372055 NRS 372185. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax.

State sales tax is 685 but localities can increase that to 81. States That Do Not Tax Retirement Income. Military pensions are fully exempt for.

Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming dont tax income at all. The same goes for. Marginal Income Tax Rates.

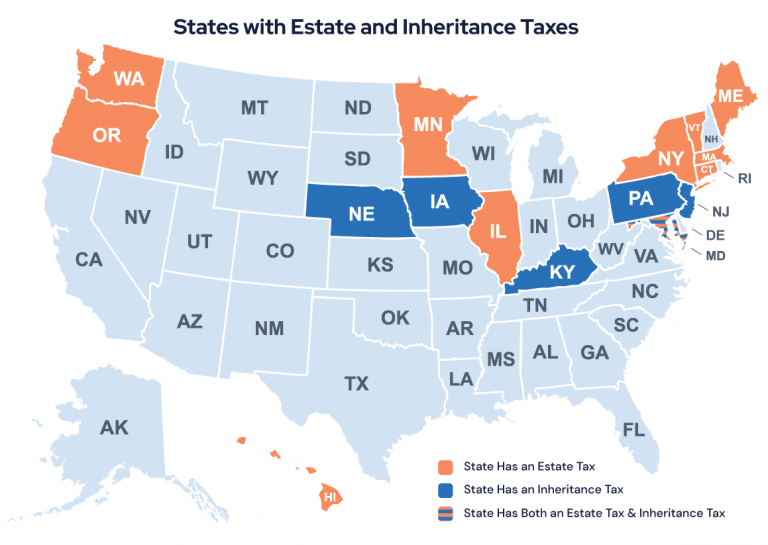

Nevada diesel tax is 2856 centsgallon. Nevada has no income tax. It also has no estate tax.

Out of all 50 states in the US 38 states and the District of Columbia do not levy a tax on Social Security benefits. 800-742-7474 or Nebraska Tax Department. There are no individual income taxes in Nevada.

If youre at least 59½ years old the Magnolia State wont tax your retirement income. Since Nevada does not have a state income tax any income from a pension from a 401k from an IRA or from any other retirement account is not taxable.

Nevada Retirement Tax Friendliness Smartasset

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

A Guide To The Best And Worst States To Retire In

Map Here Are The Best And Worst U S States For Retirement In 2020

Tax Friendly States For Retirees Best Places To Pay The Least

Tax Friendly States For Retirees Best Places To Pay The Least

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

7 States That Do Not Tax Retirement Income

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Investing For Retirement

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Nevada Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

37 States That Don T Tax Social Security Benefits The Motley Fool

State By State Guide To Taxes On Retirees Retirement Locations Retirement Advice Retirement

A Guide To The Best And Worst States To Retire In